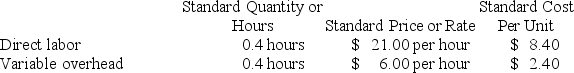

Valera Corporation makes a product with the following standards for labor and variable overhead:  The company budgeted for production of 5,300 units in July, but actual production was 5,400 units. The company used 2,130 direct labor-hours to produce this output. The actual variable overhead rate was $6.10 per hour. The company applies variable overhead on the basis of direct labor-hours.

The company budgeted for production of 5,300 units in July, but actual production was 5,400 units. The company used 2,130 direct labor-hours to produce this output. The actual variable overhead rate was $6.10 per hour. The company applies variable overhead on the basis of direct labor-hours.

The variable overhead efficiency variance for July is:

Definitions:

Declared Dividend

A dividend that has been announced by a company's board of directors to be paid out to shareholders on a specified date.

Duty of Diligence

The obligation to perform tasks, responsibilities, or research with careful and persistent effort to avoid harm to another party.

Fiduciary Duty

A legal obligation of one party to act in the best interest of another when entrusted with care of money, property, or sensitive information.

Duty of Diligence

An obligation to exercise reasonable care and diligence in the performance of obligations, typically referring to the conduct expected of directors, officers, and professionals.

Q54: Schriever Corporation is an oil well service

Q69: Familia Inc. reported the following results from

Q71: Paulis Kennel uses tenant-days as its measure

Q102: The variable overhead efficiency variance measures the

Q118: Move time is considered non-value-added time.

Q131: Incentive compensation for employees, such as bonuses,

Q144: Bickel Corporation uses customers served as its

Q171: Handerson Corporation makes a product with the

Q230: Irving Corporation makes a product with the

Q318: Bartosiewicz Clinic uses client-visits as its measure