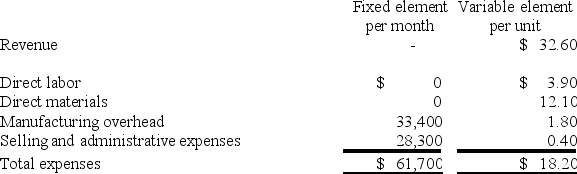

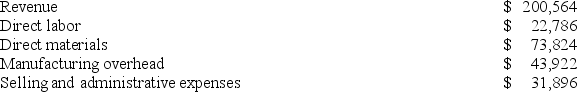

Piechocki Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During May, the company budgeted for 5,900 units, but its actual level of activity was 5,940 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for May: Data used in budgeting: Actual results for May:

Actual results for May: The spending variance for direct materials in May would be closest to:

The spending variance for direct materials in May would be closest to:

Definitions:

Average Cost

A calculation that divides the total cost of goods available for sale by the total units available for sale, offering a way to determine the cost of an item's inventory.

First-In, First-Out

An inventory valuation method where the oldest inventory items are recorded as sold first, used in both accounting and inventory management.

Last-In, First-Out

An inventory valuation method where the most recently produced items are the first to be expensed, often used in industries where inventory items are indistinguishable.

Lower-Of-Cost-Or-Market

The lower-of-cost-or-market rule is an accounting principle requiring companies to record the cost of inventory at the lower value between its original cost and current market price.

Q2: Shaak Corporation uses customers served as its

Q27: Sirignano Corporation produces and sells one product.

Q63: The following data for November have been

Q75: Seventy percent of Pitkin Corporation's sales are

Q108: Doogan Corporation makes a product with the

Q134: In a flexible budget, when the activity

Q155: Neither the net present value method nor

Q171: Harden, Inc., has budgeted sales in units

Q245: Klingshirn Corporation is a service company that

Q386: Lightsey Natural Dying Corporation measures its activity