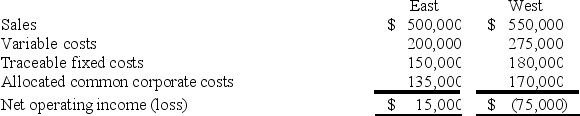

The Cook Corporation has two divisions--East and West. The divisions have the following revenues and expenses:  The management of Cook is considering the elimination of the West Division. If the West Division were eliminated, its traceable fixed costs could be avoided. Total common corporate costs would be unaffected by this decision. Given these data, the elimination of the West Division would result in an overall company net operating income (loss) of:

The management of Cook is considering the elimination of the West Division. If the West Division were eliminated, its traceable fixed costs could be avoided. Total common corporate costs would be unaffected by this decision. Given these data, the elimination of the West Division would result in an overall company net operating income (loss) of:

Definitions:

Net Profit

The amount of earnings remaining after all expenses, taxes, and costs have been subtracted from total revenue; also known as net income.

Cost of Goods Sold

The direct costs attributable to the production of goods sold by a company, including materials and labor.

Direct Costing

A costing method where only variable manufacturing costs are assigned to inventory and cost of goods sold, with fixed manufacturing overhead treated as a period cost.

Variable Costing

An accounting method that includes only variable production costs (direct materials, direct labor, and variable manufacturing overhead) in the cost of goods sold, with fixed overhead costs treated as period expenses.

Q16: Which of the following budgets are prepared

Q27: Foto Company makes 50,000 units per

Q61: Wallen Corporation is considering eliminating a department

Q64: Garry Corporation's most recent production budget indicates

Q104: Vanik Corporation currently has two divisions which

Q106: The management of Woznick Corporation has been

Q168: Hadley Corporation, which has only one product,

Q168: An expansion at Fey, Inc., would increase

Q172: Ahrends Corporation makes 70,000 units per year

Q201: Bonkowski Corporation makes one product and has