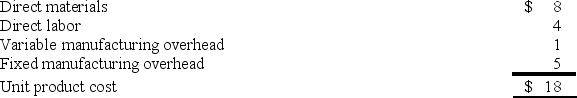

Supler Corporation produces a part used in the manufacture of one of its products. The unit product cost is $18, computed as follows:  An outside supplier has offered to provide the annual requirement of 4,000 of the parts for only $14 each. The company estimates that 60% of the fixed manufacturing overhead cost above could be eliminated if the parts are purchased from the outside supplier. Assume that direct labor is an avoidable cost in this decision. Based on these data, the financial advantage (disadvantage) of purchasing the parts from the outside supplier would be:

An outside supplier has offered to provide the annual requirement of 4,000 of the parts for only $14 each. The company estimates that 60% of the fixed manufacturing overhead cost above could be eliminated if the parts are purchased from the outside supplier. Assume that direct labor is an avoidable cost in this decision. Based on these data, the financial advantage (disadvantage) of purchasing the parts from the outside supplier would be:

Definitions:

Aldosterone

Mineralocorticoid steroid hormone produced by the adrenal cortex with action in therenal tubule to regulate sodium and potassium balance in the blood.

Sodium and Water

Vital components for physiological functions, closely regulated to maintain fluid balance, nerve transmission, and muscle function in the body.

Excretion

The process of removing waste substances from the body, primarily performed by organs like the kidneys, liver, skin, and lungs.

Jejunostomy Feeding

The provision of nutrition directly into the jejunum (part of the small intestine) through a surgically created opening known as a jejunostomy.

Q18: (Ignore income taxes in this problem.) Strausberg

Q31: Digerolamo Enterprises makes a variety of products

Q37: Deemer Corporation has an activity-based costing system

Q41: One of the employees of Davenport Corporation

Q84: Penagos Corporation is presently making part Z43

Q87: Mustafa Enterprises makes a variety of products

Q91: When the net cash inflow is the

Q92: Moorman Corporation has an activity-based costing system

Q150: Danny Dolittle makes crafts in his spare

Q161: Lusk Corporation produces and sells 10,000 units