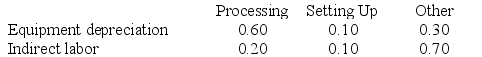

Moorman Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. The company's overhead costs consist of equipment depreciation and indirect labor and are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Equipment depreciation totals $53,000 and indirect labor totals $3,000. Data concerning the distribution of resource consumption across activity cost pools appear below:

Required:

Required:

Assign overhead costs to activity cost pools using activity-based costing.

Definitions:

Energy Drink

A type of beverage containing stimulant compounds, usually caffeine, that is marketed as providing mental and physical stimulation.

Utility

Describes the complete fulfillment derived from the use of a product or service.

Demand Curve

A graph showing the relationship between the price of a good and the amount of the good that consumers are willing to purchase at that price, ceteris paribus.

Zero Price

Refers to a situation where a good or service is offered without requiring payment; often to promote sharing or distribution efficiency.

Q32: Dejarnette Corporation uses a job-order costing system

Q38: Mirabile Corporation uses activity-based costing to compute

Q46: Lueckenhoff Corporation uses a job-order costing system

Q85: The management of Solar Corporation is considering

Q153: Wyrich Corporation has two divisions: Blue Division

Q169: Cumberland Enterprises makes a variety of products

Q172: Helmers Corporation manufactures a single product. Variable

Q176: Lueckenhoff Corporation uses a job-order costing system

Q199: A bill of materials is a document

Q199: The Carter Corporation makes products A and