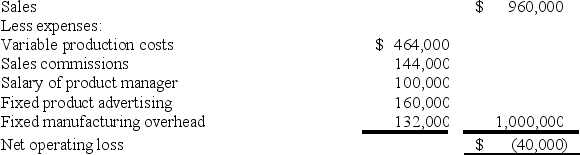

Balser Corporation manufactures and sells a number of products, including a product called JYMP. Results for last year for the manufacture and sale of JYMPs are as follows:  Balser is trying to decide whether to discontinue the manufacture and sale of JYMPs. All expenses other than fixed manufacturing overhead are avoidable if the product is dropped. None of the fixed manufacturing overhead is avoidable.

Balser is trying to decide whether to discontinue the manufacture and sale of JYMPs. All expenses other than fixed manufacturing overhead are avoidable if the product is dropped. None of the fixed manufacturing overhead is avoidable.

Assume that dropping Product JYMP would result in a $90,000 increase in the contribution margin of other products. If Balser chooses to discontinue JYMP, the annual financial advantage (disadvantage) of eliminating this product should be:

Definitions:

Export Supply

The quantity of goods or services available from a country for sale to other countries, directly related to national production capacities and international demand.

Protective Tariff

A tax imposed on imported goods to protect domestic industries from foreign competition by making the imported goods more expensive.

Tariff

A tax imposed by a government on goods and services imported from other countries.

Excise Tax

An indirect tax charged on the sale of a particular good or service, typically specific items such as alcohol, tobacco, and gasoline.

Q33: Petrini Corporation makes one product and it

Q75: A company has unlimited funds to invest

Q86: Mcfarlain Corporation is presently making part U98

Q96: Lambert Manufacturing has $120,000 to invest in

Q97: Scholfield Enterprises makes a variety of products

Q98: Caspion Corporation makes and sells a product

Q117: Cardle Corporation makes one product. Budgeted unit

Q158: The term joint cost is used to

Q170: Orbit Airlines is considering the purchase of

Q183: A joint product is:<br>A) any product which