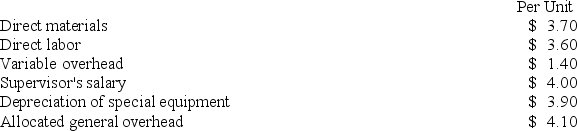

Mcfarlain Corporation is presently making part U98 that is used in one of its products. A total of 7,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce and sell the part to the company for $17.10 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

An outside supplier has offered to produce and sell the part to the company for $17.10 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

In addition to the facts given above, assume that the space used to produce part U98 could be used to make more of one of the company's other products, generating an additional segment margin of $24,000 per year for that product. What would be the financial advantage (disadvantage) of buying part U98 from the outside supplier and using the freed space to make more of the other product?

Definitions:

Cooperatives

Business organizations owned and operated by a group of individuals for their mutual benefit, where members democratically control the operations and profits are distributed according to each member's contribution.

Legal Taxable Entity

An organization or individual subject to tax laws, with an obligation to file tax returns and pay taxes based on income or transactions.

Shares of Stock

Units of ownership interest in a corporation or financial asset, giving shareholders a claim on part of the company's assets and earnings.

Issuing Stock

The process by which a company distributes shares to investors for the first time, typically to raise capital for expansion or other corporate activities.

Q8: Elfalan Corporation produces a single product. The

Q37: Deemer Corporation has an activity-based costing system

Q67: Munafo Corporation is a specialty component manufacturer

Q69: When using data from a segmented income

Q122: Goertz Corporation has an activity-based costing system

Q124: (Ignore income taxes in this problem.) The

Q132: Kulka Corporation manufactures two products: Product F82D

Q147: Bruce Corporation makes four products in a

Q188: Mirabile Corporation uses activity-based costing to compute

Q278: Kern Corporation produces a single product. Selected