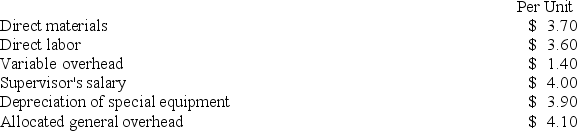

Mcfarlain Corporation is presently making part U98 that is used in one of its products. A total of 7,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce and sell the part to the company for $17.10 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

An outside supplier has offered to produce and sell the part to the company for $17.10 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

If management decides to buy part U98 from the outside supplier rather than to continue making the part, what would be the annual financial advantage (disadvantage) ?

Definitions:

Benchmark Test

An evaluation or test that uses a set of standards or an established reference point to measure the performance of a product or service.

Pretest

An evaluation of advertisements by a sample of targeted consumers before an ad campaign begins.

Posttest

An evaluation of advertisements after the ad campaign is launched by a sample of targeted consumers.

Objective-and-Task Method

A budgeting approach where the budget is set based on the cost of specific tasks or objectives that must be accomplished to achieve marketing goals.

Q17: Michard Corporation makes one product and it

Q61: Carver Lumber sells lumber and general

Q126: Carver Lumber sells lumber and general

Q128: Recher Corporation uses part Q89 in one

Q132: The management of Elamin Corporation is considering

Q147: Miscavage Corporation has two divisions: the Beta

Q169: Cumberland Enterprises makes a variety of products

Q172: Ahrends Corporation makes 70,000 units per year

Q209: Mandato Corporation has provided the following data

Q272: Baraban Corporation has provided the following data