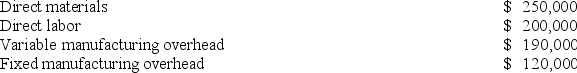

Melbourne Corporation has traditionally made a subcomponent of its major product. Annual production of 30,000 subcomponents results in the following costs:  Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit. Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for $80,000 per year if the subcomponent were purchased from the outside supplier. There would be no effect of this decision on the total fixed manufacturing overhead of the company. Assume that direct labor is a variable cost.

Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit. Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for $80,000 per year if the subcomponent were purchased from the outside supplier. There would be no effect of this decision on the total fixed manufacturing overhead of the company. Assume that direct labor is a variable cost.

If Melbourne decides to purchase the subcomponent from the outside supplier, the annual financial advantage (disadvantage) would be:

Definitions:

Payroll Info Tab

A section within financial or HR software where employee payment data such as wages and tax withholdings are managed.

Company Preferences

Settings or configurations chosen by a company within software or systems to align with their operational procedures and policies.

Diamonds

Hard, precious gems formed under high temperature and pressure conditions, commonly used in jewelry and industrial applications.

Secure Transactions

Financial or data exchanges that are protected against fraud, theft, or unauthorized access through various security measures.

Q5: Saalfrank Corporation is considering two alternatives that

Q17: Fast Food, Inc., has purchased a new

Q29: Silver Corporation produces a single product. Last

Q32: Accepting a special order will improve overall

Q60: In activity-based costing, a product margin may

Q79: Tilson Corporation has projected sales and production

Q143: Congener Beverage Corporation is considering an investment

Q151: The Draper Corporation is considering dropping its

Q191: Michard Corporation makes one product and it

Q254: Elison Corporation, which has only one product,