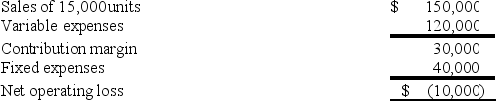

The Draper Corporation is considering dropping its Doombug toy due to continuing losses. Data on the toy for the past year follow:  If the toy were discontinued, Draper could avoid $8,000 per year in fixed costs. The remainder of the fixed costs are not avoidable.

If the toy were discontinued, Draper could avoid $8,000 per year in fixed costs. The remainder of the fixed costs are not avoidable.

Suppose that if the Doombug toy is dropped, the production and sale of other Draper toys would increase so as to generate a $16,000 increase in the contribution margin received from these other toys. If all other conditions are the same, the financial advantage (disadvantage) from discontinuing the production and sale of Doombugs would be:

Definitions:

Average Operating Assets

Average operating assets are calculated as the average total assets used in day-to-day operations over a specified period, typically used in performance measurement.

Return on Investment

A performance measure used to evaluate the efficiency or profitability of an investment, calculated by dividing net profit by the cost of the investment.

Units per Year

A measure of production output or activity volume, indicating the number of units produced or sold within a year.

ROI Computation

The calculation of Return on Investment, which measures the gain or loss generated on an investment relative to the amount of money invested.

Q19: Meester Corporation has an activity-based costing system

Q57: Crocetti Corporation makes one product and has

Q61: Nick Company has two products: A and

Q92: Moorman Corporation has an activity-based costing system

Q117: Anglen Co. manufactures and sells trophies

Q174: Ouzts Corporation is considering Alternative A and

Q184: The Bharu Violin Corporation has the capacity

Q185: Caspion Corporation makes and sells a product

Q186: A customer has asked Lalka Corporation to

Q242: Erie Corporation manufactures a single product that