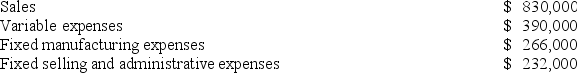

The management of Bonga Corporation is considering dropping product D74F. Data from the company's accounting system for this product for last year appear below:  All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $111,000 of the fixed manufacturing expenses and $103,000 of the fixed selling and administrative expenses are avoidable if product D74F is discontinued.

All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $111,000 of the fixed manufacturing expenses and $103,000 of the fixed selling and administrative expenses are avoidable if product D74F is discontinued.

What would be the financial advantage (disadvantage) from dropping product D74F?

Definitions:

Leverage Ratios

Financial ratios that measure the extent to which a firm uses debt as a source of financing and its ability to service that debt.

Financing

The process of providing or obtaining the funds necessary for an investment, project, or business venture.

Debt

An amount of money borrowed by one party from another under the condition that it is to be repaid, usually with interest.

Net Profit Margin

A profitability ratio that measures the percentage of each sales dollar that remains as profit after all expenses, including taxes, have been paid.

Q7: Glover Company makes three products in a

Q71: Wedd Corporation uses activity-based costing to assign

Q72: In the second-stage allocation in activity-based costing,

Q112: Boney Corporation processes sugar beets that it

Q127: Banfield Corporation makes three products that use

Q138: The LFH Corporation makes and sells a

Q152: Dukelow Corporation has two divisions: the Governmental

Q162: Perl Corporation uses an activity-based costing system

Q181: Neef Corporation has provided the following data

Q186: The LaGrange Corporation had the following budgeted