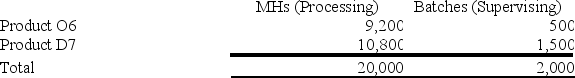

Wedd Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $27,200; Supervising, $9,300; and Other, $9,500. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  The activity rate for the Processing activity cost pool under activity-based costing is closest to:

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

Definitions:

Permanent Employee

An employee hired for an indefinite duration, often with full-time hours and access to benefits.

Labor Market

The supply and demand for workers, in which employers seek to hire labor and workers look for jobs.

Sophisticated Language

Refers to advanced, highly developed, or complex language often used in specific professional, academic, or cultural contexts for precision and clarity.

Market Value

The current price at which an asset or service can be bought or sold in the marketplace.

Q1: Oriental Corporation has gathered the following data

Q5: Saalfrank Corporation is considering two alternatives that

Q38: The management of Schmader Corporation is considering

Q113: Fletes Corporation manufactures two products: Product O95C

Q121: Organization-sustaining activities relate to specific customers and

Q123: Under the absorption costing method, a company

Q143: Bertie Corporation has two divisions: Retail Division

Q157: Mccrone Corporation has provided the following data

Q196: The appeal of using multiple departmental overhead

Q257: Jemmott Corporation has two divisions: Western Division