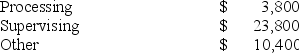

Mirabile Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

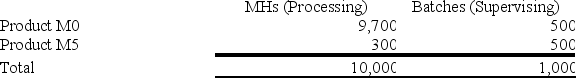

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

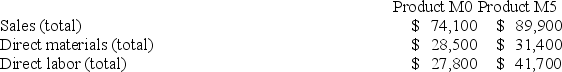

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins. What is the overhead cost assigned to Product M5 under activity-based costing?

What is the overhead cost assigned to Product M5 under activity-based costing?

Definitions:

Financial Obligations

Money owed by an individual or organization to another entity under terms specified in a contract.

Bankruptcy and Insolvency Act

A statute of Canada that governs bankruptcy and insolvency law, providing for the legal process by which individuals or companies unable to meet their financial obligations can seek relief.

Personal Property Security Act

Legislation that provides for the creation and registration of security interests in personal property to secure payment or performance of an obligation.

Bankruptcy

A legal process for individuals or entities that are unable to repay their outstanding debts, providing a mechanism for dealing with financial insolvency.

Q12: The Tolar Corporation has 400 obsolete desk

Q21: If the overhead rate is computed annually

Q49: Decorte Corporation uses a job-order costing system

Q61: Nick Company has two products: A and

Q65: Data concerning three of the activity cost

Q78: Marley Corporation makes three products (X, Y,

Q135: Keyser Corporation, which has only one product,

Q152: Vandezande Inc. is considering the acquisition of

Q155: Hosley Corporation uses an activity-based costing system

Q248: Parido Corporation has two manufacturing departments--Casting and