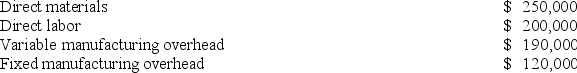

Melbourne Corporation has traditionally made a subcomponent of its major product. Annual production of 30,000 subcomponents results in the following costs:  Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit. Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for $80,000 per year if the subcomponent were purchased from the outside supplier. There would be no effect of this decision on the total fixed manufacturing overhead of the company. Assume that direct labor is a variable cost.

Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit. Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for $80,000 per year if the subcomponent were purchased from the outside supplier. There would be no effect of this decision on the total fixed manufacturing overhead of the company. Assume that direct labor is a variable cost.

If Melbourne decides to purchase the subcomponent from the outside supplier, the annual financial advantage (disadvantage) would be:

Definitions:

Certificate of Deposit

A savings certificate with a fixed maturity date and interest rate, issued by a bank to a person depositing money for a specified period of time.

Corporate Bonds

Debt securities issued by corporations to finance operations, typically offering fixed interest payments.

Convertible Bond

A type of bond that allows the bondholder to convert the bond into a predetermined number of shares of the issuing company, usually at certain times during its life.

Callable Bond

A kind of security that the issuer has the option to buy back prior to its maturity at a set price.

Q15: First-stage allocations in an ABC system should

Q23: A company is pondering an investment project

Q28: The manufacturing overhead budget at Polich Corporation

Q93: The management of Bonga Corporation is considering

Q119: The Jabba Corporation manufactures the "Snack Buster"

Q157: Mccrone Corporation has provided the following data

Q166: Deemer Corporation has an activity-based costing system

Q235: Absorption costing treats all fixed costs as

Q240: Nuzum Corporation has two divisions: Division M

Q244: Moskowitz Corporation has provided the following data