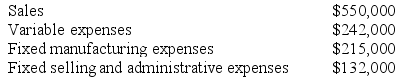

The management of Schmader Corporation is considering dropping product M12C. Data from the company's accounting system appear below:

All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $137,000 of the fixed manufacturing expenses and $79,000 of the fixed selling and administrative expenses are avoidable if product M12C is discontinued.

All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $137,000 of the fixed manufacturing expenses and $79,000 of the fixed selling and administrative expenses are avoidable if product M12C is discontinued.

Required:

a. What is the net operating income earned by product M12C according to the company's accounting system? Show your work!

b. Determine the financial advantage (disadvantage) for the company of dropping product M12C. Should the product be dropped? Show your work!

Definitions:

Accumulated Depreciation

The total amount of depreciation expense that has been recorded against a fixed asset since it was acquired, reflecting its use and wear over time.

Investing Activity

A category in financial statements that represents cash flows related to the purchase or sale of long-term assets or investments.

Statement Of Cash Flows

A financial statement that highlights the major activities that impact cash flows and, hence, affect the overall cash balance.

Sale Of Equipment

The process of selling off business assets, such as machinery or office equipment, usually to generate cash.

Q7: When a company shifts from a traditional

Q21: Wyrich Corporation has two divisions: Blue Division

Q65: Data concerning three of the activity cost

Q74: Respass Corporation has provided the following data

Q91: Hesterman Corporation makes one product and has

Q122: The management of Hibert Corporation is considering

Q131: Sarafiny Corporation is in the process of

Q158: Plummer Corporation has provided the following data

Q166: Goergen Corporation is considering a capital budgeting

Q169: Rebelo Corporation is presently making part E07