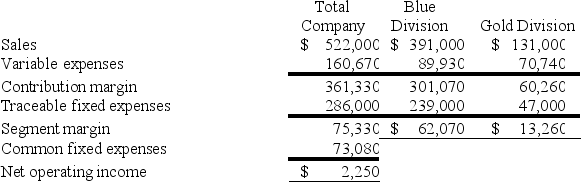

Wyrich Corporation has two divisions: Blue Division and Gold Division. The following report is for the most recent operating period:  The Gold Division's break-even sales is closest to:

The Gold Division's break-even sales is closest to:

Definitions:

Progressive

Relating to progressive policies or taxes, which are designed to have a greater impact on those who are able to pay more.

U.S. Tax System

A system governing how taxes are collected from individuals and businesses by the federal, state, and local governments in the United States, covering income, sales, property, and other taxes.

Slightly Regressive

Refers to a tax system or policy that places a relatively higher tax burden on low-income earners compared to high-income earners, but the difference is not pronounced.

Excise Tax

A tax directly levied on specific goods or services, such as tobacco or gasoline, usually to discourage their use or generate revenue.

Q5: An activity rate of $512 per product

Q51: Housholder Corporation uses a predetermined overhead rate

Q64: Hopi Corporation expects the following operating results

Q81: Hagy Corporation has an activity-based costing system

Q88: Petteway Corporation has two divisions: Home Division

Q94: A duration driver provides a simple count

Q104: Borunda Corporation has provided the following data

Q152: Doede Corporation uses activity-based costing to compute

Q152: Dukelow Corporation has two divisions: the Governmental

Q243: Kluth Corporation has two manufacturing departments--Molding and