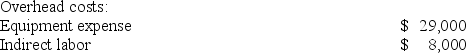

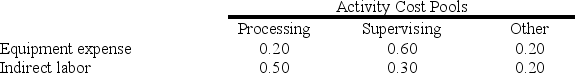

Bartow Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment expense and indirect labor--are allocated to the three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

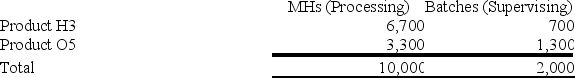

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity: How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Unearned Revenues

Monies received by a company for goods or services yet to be delivered or performed, considered a liability until the obligation is fulfilled.

Liability

Financial obligations or debts that an entity owes to others, which must be settled over time through the transfer of economic benefits.

Customer Payment

Payment made by a customer for goods or services provided, typically recorded as revenue by the receiving business.

Equity Account

An account that represents the owner's or shareholders' residual interest in the assets of a company after deducting liabilities.

Q33: Bitonti Corporation has provided the following data

Q59: When using segmented income statements, the dollar

Q79: Zouar Computer Corporation currently manufactures the disk

Q90: The Cook Corporation has two divisions--East and

Q142: Ober Corporation, which has only one product,

Q169: Krier Corporation uses a predetermined overhead rate

Q184: The Bharu Violin Corporation has the capacity

Q207: Scholfield Enterprises makes a variety of products

Q224: Tat Corporation produces a single product and

Q252: Clemeson Corporation, which has only one product,