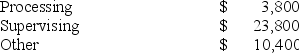

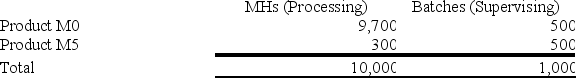

Mirabile Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

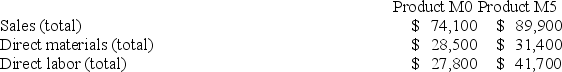

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins. What is the overhead cost assigned to Product M5 under activity-based costing?

What is the overhead cost assigned to Product M5 under activity-based costing?

Definitions:

Present Value Factor

A multiplier used to determine the present value of a future sum of money or stream of cash flows given a specific discount rate.

Future Value Factor

A factor used in time value of money calculations that determines the future value of a present sum of money or a series of payments, accounting for compounding interest.

Reciprocals

The mathematical result of dividing 1 by a given number; a reciprocal of a fraction is its inverse.

Present Value

The current valuation of money to be received in the future or ongoing cash flows, based on a predetermined return rate.

Q1: A cost that will be incurred regardless

Q9: A project requires an initial investment of

Q18: The following are Silver Corporation's unit costs

Q58: Elfalan Corporation produces a single product. The

Q60: A cost that is assigned to a

Q90: Ciulla Corporation manufactures two products: Product J12N

Q131: Variable costing net operating income is usually

Q139: (Ignore income taxes in this problem.) The

Q162: Longobardi Corporation bases its predetermined overhead rate

Q195: Activity-based costing is a costing method that