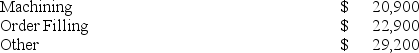

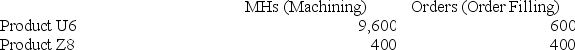

Flemming Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Machining, Order Filling, and Other. The costs in those activity cost pools appear below:  Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

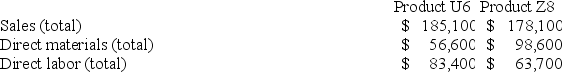

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins. What is the product margin for Product U6 under activity-based costing?

What is the product margin for Product U6 under activity-based costing?

Definitions:

Independent Variables

Elements in research or a scenario that are altered or sorted to explore their influence on response variables.

Regression Equation

An equation that expresses the linear relationship between one or more independent variables and a dependent variable.

Variation

The measure of dispersion within a dataset, indicating how much individual data points differ from the average value.

First-order Model

A simple linear model that describes a relationship between two variables with a direct correlation, without considering complex interactions.

Q6: Bryans Corporation has provided the following data

Q41: One of the employees of Davenport Corporation

Q44: Daher Corporation manufactures two products: Product A34R

Q58: Net operating income computed under variable costing

Q62: One way to increase the effective utilization

Q72: In the second-stage allocation in activity-based costing,

Q81: The Anaconda Mining Company currently is operating

Q131: Variable costing net operating income is usually

Q137: In activity-based costing, as in traditional costing

Q181: Activity-based costing is best proposed, designed and