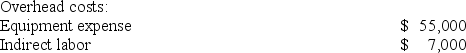

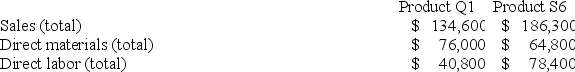

Scheuer Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment expense and indirect labor--to three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

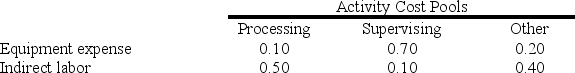

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

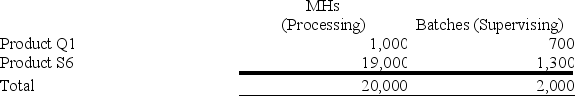

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Sales and Direct Cost Data: What is the product margin for Product Q1 under activity-based costing?

What is the product margin for Product Q1 under activity-based costing?

Definitions:

Supporting Documents

Paperwork or electronic files that provide evidence or back up for transactions recorded in an accounting system.

Electronic Funds Transfers

Digital transfers of money from one bank account to another either within the same financial institution or across different institutions.

Cash Collections

The process of receiving and managing payments from customers for goods or services provided.

Change Fund

A change fund is a set amount of money, composed of various denominations, used to make change for transactions in business operations.

Q27: Joetz Corporation has gathered the following data

Q48: Meester Corporation has an activity-based costing system

Q99: Vannorman Corporation processes sugar beets in batches.

Q99: The Kamienski Cleaning Brigade Company provides housecleaning

Q106: Davison Corporation, which has only one product,

Q145: Horgen Corporation manufactures two products: Product M68B

Q168: Hadley Corporation, which has only one product,

Q207: Coates Corporation uses a job-order costing system

Q236: Columbia Corporation produces a single product. The

Q262: Beans Corporation uses a job-order costing system