Figge & Mathews PLC, a consulting firm, uses an activity-based costing in which there are three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system:

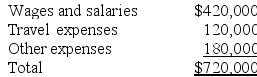

Costs:

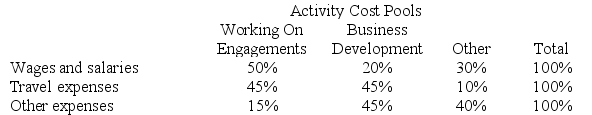

Distribution of resource consumption:

Distribution of resource consumption:

Required:

Required:

a. How much cost, in total, would be allocated to the Working On Engagements activity cost pool?

b. How much cost, in total, would be allocated to the Business Development activity cost pool?

c. How much cost, in total, would be allocated to the Other activity cost pool?

Definitions:

Producer Surplus

The difference between the amount a producer is paid for a good versus what they would have been willing to accept, reflecting the benefit to producers from participating in the market.

Consumer Surplus

The difference between the total amount consumers are willing to pay for a good or service and the total amount they actually pay.

Marginal Revenue Function

A mathematical formula that shows the additional revenue generated by selling one more unit of a good or service.

High Definition Television

Television systems that have a higher resolution than standard-definition television, offering viewers more detailed and clearer images.

Q12: Kaaua Corporation has provided the following data

Q47: Highpoint, Inc., is considering investing in automated

Q60: A cost that is assigned to a

Q61: Bernson Corporation is using a predetermined overhead

Q78: Chang Corporation has two divisions, T and

Q146: Priddy Corporation processes sugar cane in batches.

Q154: Neelon Corporation has two divisions: Southern Division

Q172: Ahrends Corporation makes 70,000 units per year

Q182: Addleman Corporation has an activity-based costing system

Q204: Neef Corporation has provided the following data