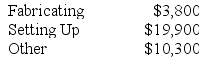

Sukhu Corporation's activity-based costing system has three activity cost pools--Fabricating, Setting Up, and Other. The company's overhead costs have already been allocated to these cost pools as follows:

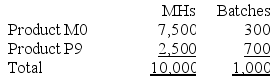

Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

Required:

Required:

Calculate activity rates for each activity cost pool using activity-based costing.

Definitions:

Office 2013

A version of Microsoft Office, a suite of productivity applications, which includes programs like Word, Excel, PowerPoint, and Outlook.

Temporary Copy

A transient duplication of data made to assist in editing or manipulation tasks, often stored in volatile memory.

Device Limit

The maximum number of devices that can be connected to or registered with a service or software application.

Microsoft Lync

A discontinued instant messaging client used for online meetings and video conferencing.

Q27: Dejarnette Corporation uses a job-order costing system

Q54: Neelon Corporation has two divisions: Southern Division

Q120: Part S51 is used in one of

Q129: Gutknecht Corporation uses an activity-based costing system

Q153: Ouzts Corporation is considering Alternative A and

Q184: Camm Corporation has two manufacturing departments--Forming and

Q188: Mirabile Corporation uses activity-based costing to compute

Q191: The Melville Corporation produces a single product

Q203: Orozco Enterprises makes a variety of products

Q259: Tancredi Corporation has two manufacturing departments--Machining and