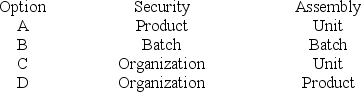

Factory security and assembly activities at an appliance manufacturing plant would be best classified as unit-level, batch-level, product-level, or organization-sustaining activities?

Definitions:

Scrap Value

The calculated resale value of an asset at the termination of its functional life.

MACRS Tables

Guidelines used in the United States for calculating depreciation deductions for tax purposes under the Modified Accelerated Cost Recovery System.

Allowable Depreciation

The deduction a company can take over the useful life of an asset, as determined by tax laws, to account for wear and tear.

Straight-Line Method

A method of calculating depreciation by evenly spreading the cost of an asset over its useful life.

Q2: Kray Inc., which produces a single product,

Q26: The book value of an old machine

Q32: Accepting a special order will improve overall

Q51: (Ignore income taxes in this problem.) The

Q68: EMD Corporation manufactures two products, Product S

Q109: The Tolar Corporation has 400 obsolete desk

Q117: The management of Penfold Corporation is considering

Q150: (Ignore income taxes in this problem.) Gallatin,

Q166: Benjamin Company produces products C, J, and

Q196: The appeal of using multiple departmental overhead