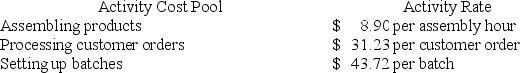

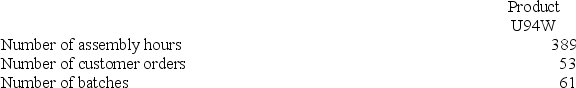

Hane Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:  Data for one of the company's products follow:

Data for one of the company's products follow: How much overhead cost would be assigned to Product U94W using the activity-based costing system?

How much overhead cost would be assigned to Product U94W using the activity-based costing system?

Definitions:

Taxes

Essential monetary obligations or assorted forms of taxes imposed on individuals by government organizations, designed to facilitate government budgeting and various public expenditure.

Average Tax Rate

The proportion of total income that is paid in taxes, calculated by dividing the total tax paid by the taxpayer’s total income.

Taxable Income

The portion of an individual's or organization's income used to calculate how much tax will be owed to the government.

Federal Government

The national government of a federated state, which holds the authority to govern the country at a national or federal level, distinct from regional or local governments.

Q6: Immen Corporation manufactures two products: Product B82O

Q13: Oriental Corporation has gathered the following data

Q29: Marsdon Company has an annual production

Q61: Carver Lumber sells lumber and general

Q94: The simple rate of return is computed

Q95: Foster Florist specializes in large floral bouquets

Q115: Doede Corporation uses activity-based costing to compute

Q189: Mae Refiners, Inc., processes sugar cane that

Q192: Product U23N has been considered a drag

Q196: When activity-based costing is used for internal