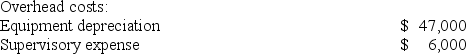

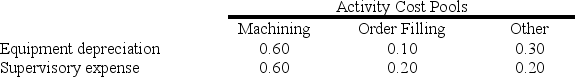

Lysiak Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment depreciation and supervisory expense-are allocated to three activity cost pools--Machining, Order Filling, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

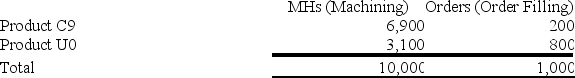

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity: The activity rate for the Machining activity cost pool under activity-based costing is closest to:

The activity rate for the Machining activity cost pool under activity-based costing is closest to:

Definitions:

Q51: Common fixed expenses should not be allocated

Q58: Elfalan Corporation produces a single product. The

Q62: A company has provided the following data

Q84: Tustin Corporation has provided the following data

Q90: The Cook Corporation has two divisions--East and

Q92: Moorman Corporation has an activity-based costing system

Q109: Lambert Manufacturing has $120,000 to invest in

Q140: In preference decisions, the profitability index and

Q159: Lakeshore Tours Inc., operates a large number

Q180: Aaron Corporation, which has only one product,