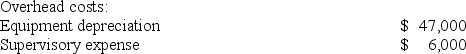

Lysiak Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment depreciation and supervisory expense-are allocated to three activity cost pools--Machining, Order Filling, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

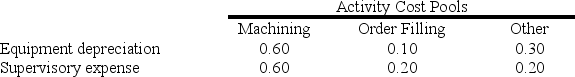

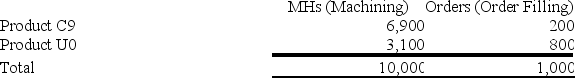

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity: What is the overhead cost assigned to Product C9 under activity-based costing?

What is the overhead cost assigned to Product C9 under activity-based costing?

Definitions:

Capital Structure

Refers to the blend of debt, equity, and other financing sources used by a company to fund its operations and growth endeavors.

Retained Earnings

The portion of net earnings not paid out as dividends but retained by the company to reinvest in its core business or to pay debt.

Depreciation Expense

A method for allocating the cost of a tangible asset over its useful life, reflecting the asset's consumption, wear and tear, or obsolescence.

Flotation Costs

The costs incurred by a company when it issues new securities, including underwriting fees, legal fees, and registration fees.

Q17: Addleman Corporation has an activity-based costing system

Q44: Lefelmann Corporation, which has only one product,

Q75: The Freed Corporation produces three products, X,

Q90: Cahalane Corporation has provided the following data

Q109: Lambert Manufacturing has $120,000 to invest in

Q112: Helland Corporation uses a job-order costing system

Q128: Recher Corporation uses part Q89 in one

Q151: Direct materials costs are usually excluded from

Q164: Byerly Corporation has provided the following data

Q239: Job-order costing systems often use allocation bases