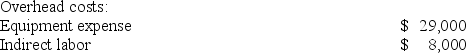

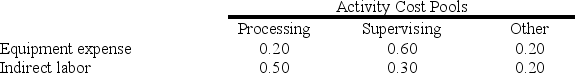

Bartow Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment expense and indirect labor--are allocated to the three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

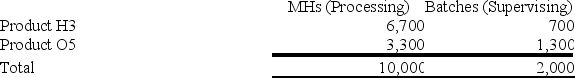

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity: How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Q3: Swagger Corporation purchases potatoes from farmers. The

Q34: (Ignore income taxes in this problem.) Boxton

Q98: Given the following data (Ignore income taxes.):

Q116: Aaron Corporation, which has only one product,

Q154: Provenzano Corporation manufactures two products: Product B56Z

Q155: Stinehelfer Beet Processors, Inc., processes sugar beets

Q162: Perl Corporation uses an activity-based costing system

Q182: Smidt Corporation has provided the following data

Q204: Tatman Corporation uses an activity-based costing system

Q275: If a job is not completed at