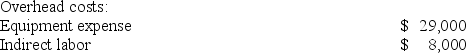

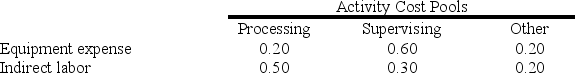

Bartow Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment expense and indirect labor--are allocated to the three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

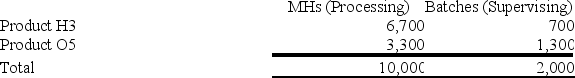

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity: What is the overhead cost assigned to Product H3 under activity-based costing?

What is the overhead cost assigned to Product H3 under activity-based costing?

Definitions:

Average Variable Cost

The variable cost per unit of output, calculated by dividing total variable costs by the quantity of output produced.

Perfectly Competitive

Describes a market structure where numerous small firms compete against each other, and no single entity has market power to set the price of a homogeneous product.

Market Price

The price at which a good or service is offered in the marketplace, determined by supply and demand forces.

Marginal Cost

The increase in total cost that arises from producing an additional unit of output, reflecting the cost of producing one more unit.

Q14: The variable costs of a product are

Q54: The management of Lanzilotta Corporation is considering

Q133: Scheuer Corporation uses activity-based costing to compute

Q146: Handal Corporation uses activity-based costing to compute

Q173: If the allocation base in the predetermined

Q173: Consider the following production and cost data

Q175: When a company is involved in more

Q193: Assuming the LIFO inventory flow assumption, when

Q244: In a job-order cost system, indirect labor

Q259: Gabuat Corporation, which has only one product,