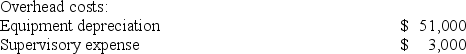

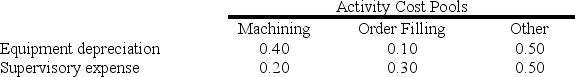

Goertz Corporation has an activity-based costing system with three activity cost pools--Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools: Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

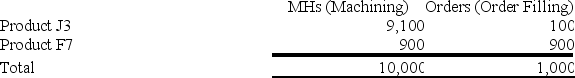

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity: Finally, the costs of Machining and Order Filling are combined with the following sales and direct cost data to determine product margins.

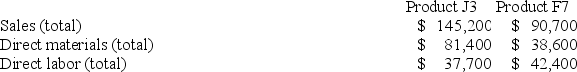

Finally, the costs of Machining and Order Filling are combined with the following sales and direct cost data to determine product margins.

Sales and Direct Cost Data: What is the overhead cost assigned to Product F7 under activity-based costing?

What is the overhead cost assigned to Product F7 under activity-based costing?

Definitions:

Introjective Tests

Psychological tests that analyze an individual's internal thoughts, feelings, and other mental processes, often through projective techniques.

Rating Scales

Tools or instruments used to measure or evaluate the quantity or degree of an attribute or characteristic.

Observer Effect

The phenomenon in which the act of observation alters the behavior of the subject being observed, often considered in psychological research and quantum physics.

Experimenter Bias

A form of research bias where the expectations of the researcher unintentionally influence the outcome of an experiment.

Q15: The Wester Corporation produces three products with

Q50: The controller of Hendershot Corporation estimates the

Q55: Deemer Corporation has an activity-based costing system

Q67: Munafo Corporation is a specialty component manufacturer

Q104: Vanik Corporation currently has two divisions which

Q125: Toxemia Salsa Corporation manufactures five flavors of

Q139: Branin Corporation uses a job-order costing system

Q146: An investment project requires an initial investment

Q188: Phinisee Corporation manufactures a single product. The

Q194: Hamby Corporation is preparing a bid for