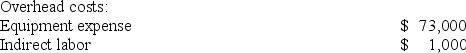

Addleman Corporation has an activity-based costing system with three activity cost pools--Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

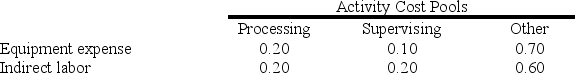

Distribution of Resource Consumption Across Activity Cost Pools: Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

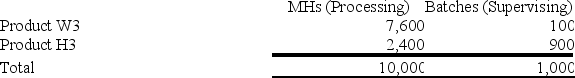

Activity: Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.

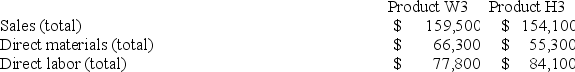

Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.

Sales and Direct Cost Data: What is the product margin for Product H3 under activity-based costing?

What is the product margin for Product H3 under activity-based costing?

Definitions:

Treasury Bills

Short-term government securities with maturities of one year or less, sold at a discount to their face value.

Market Efficiency

A concept in financial economics that describes how well market prices reflect all available information, leading to assets being properly priced and markets allocating resources efficiently.

Financial Decision Maker

An individual or group responsible for making investment, financing, and dividend decisions within an organization.

Expected NPV

Projected Net Present Value; an estimation of a project's current value based on expected future cash flows discounted at the project's cost of capital.

Q17: Corbett Corporation manufactures a single product. Last

Q33: The net present value method assumes that

Q50: The controller of Hendershot Corporation estimates the

Q62: A company has provided the following data

Q111: Job cost sheets contain entries for actual

Q127: Bartow Corporation uses an activity based costing

Q129: Gutknecht Corporation uses an activity-based costing system

Q214: A company that produces a single product

Q275: Danahy Corporation manufactures a single product. The

Q285: Mullee Corporation produces a single product and