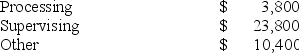

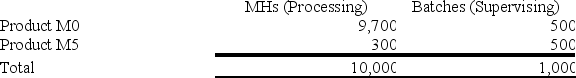

Mirabile Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

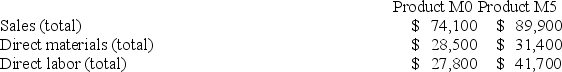

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins. What is the product margin for Product M5 under activity-based costing?

What is the product margin for Product M5 under activity-based costing?

Definitions:

Actual Costs

Expenses that have been incurred and recorded, contrasting with estimated or projected costs.

Management

The process of directing, controlling, and organizing resources in an organization towards achieving its goals.

Inventoriable Costs

Costs that are initially recorded as inventory on the balance sheet and recognized as cost of goods sold only when the inventory is sold.

Freight Charges

Costs associated with transporting goods from one location to another, often incurred by the seller to deliver goods to a customer.

Q8: (Ignore income taxes in this problem.) Ursus,

Q43: Nantor Corporation has two divisions, Southern and

Q53: Gerstein Corporation uses a job-order costing system

Q62: A company has provided the following data

Q84: Purvell Corporation has just acquired a new

Q94: Absorption costing treats all manufacturing costs as

Q108: Stomberg Corporation has provided the following data

Q149: Torello Corporation manufactures two products: Product H95V

Q192: Product U23N has been considered a drag

Q218: Davitt Corporation produces a single product and