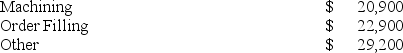

Flemming Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Machining, Order Filling, and Other. The costs in those activity cost pools appear below:  Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

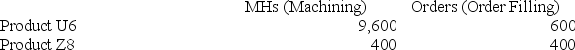

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

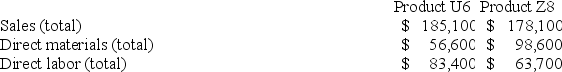

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins. What is the overhead cost assigned to Product U6 under activity-based costing?

What is the overhead cost assigned to Product U6 under activity-based costing?

Definitions:

Investing Activities

Transactions and events that involve the purchase and sale of long-term assets and other investments not generally considered cash equivalents.

Capital to Purchase Fixed Assets

Financial resources allocated for the purchase of long-term physical assets that a company uses in its operations.

Cash Flow Statement

A financial document providing comprehensive detail about a company's cash inflows and outflows over a specified period.

Noncash Asset

Assets owned by a business not in the form of cash but may be converted into cash within a year, such as inventory and property.

Q64: Gordon Corporation produces 1,000 units of a

Q85: Bertucci Corporation makes three products that use

Q107: Tat Corporation produces a single product and

Q156: Oriental Corporation has gathered the following data

Q161: Lusk Corporation produces and sells 10,000 units

Q178: The Melville Corporation produces a single product

Q179: Lueckenhoff Corporation uses a job-order costing system

Q205: Ben Corporation manufactures two products: Product E05G

Q212: Variable costing is more compatible with cost-volume-profit

Q242: Which of the following statements about using