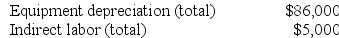

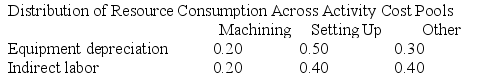

Howell Corporation's activity-based costing system has three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs, which consist of equipment depreciation and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.

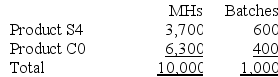

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products.

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products.

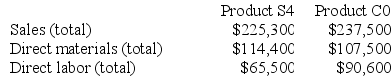

Additional data concerning the company's products appears below:

Additional data concerning the company's products appears below:

Required:

Required:

a. Assign overhead costs to activity cost pools using activity-based costing.

b. Calculate activity rates for each activity cost pool using activity-based costing.

c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

d. Determine the product margins for each product using activity-based costing.

Definitions:

Natural Ecosystems

Natural ecosystems are biological communities that interact with their physical environment, functioning through naturally occurring processes without significant human intervention.

Dead Organic Material

Non-living plant and animal matter that has not yet decayed, providing nutrients and energy sources for decomposers in ecosystems.

Recycle

The process of collecting and processing materials that would otherwise be thrown away as trash and turning them into new products.

Nutrients

Substances that provide nourishment essential for growth and the maintenance of life.

Q7: Glover Company makes three products in a

Q48: Meester Corporation has an activity-based costing system

Q67: A manufacturing company that produces a single

Q72: In the second-stage allocation in activity-based costing,

Q81: The Anaconda Mining Company currently is operating

Q82: In an ABC system, departmental managers are

Q107: Immen Corporation manufactures two products: Product B82O

Q124: Deloria Corporation has two production departments, Forming

Q139: (Ignore income taxes in this problem.) The

Q248: Parido Corporation has two manufacturing departments--Casting and