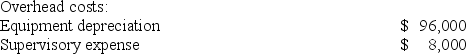

Meester Corporation has an activity-based costing system with three activity cost pools--Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

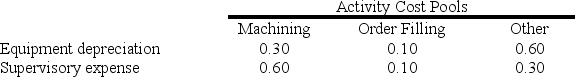

Distribution of Resource Consumption Across Activity Cost Pools: Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

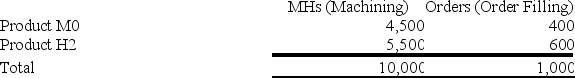

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity: What is the overhead cost assigned to Product H2 under activity-based costing?

What is the overhead cost assigned to Product H2 under activity-based costing?

Definitions:

Mechanics

The branch of physics concerned with the motion of objects and the forces that cause this motion.

Audience Analysis

The process of examining and understanding the characteristics of the audience for whom a message is intended.

Editing Skills

The ability to revise and improve a text by correcting errors and making it clearer and more effective.

Changing The Emphasis

Altering the focus or priority in a discussion, project, or strategy to highlight different aspects or objectives.

Q17: Addleman Corporation has an activity-based costing system

Q17: Fast Food, Inc., has purchased a new

Q32: Becker Billing Systems, Inc., has an antiquated

Q46: Addleman Corporation has an activity-based costing system

Q51: (Ignore income taxes in this problem.) The

Q54: Neelon Corporation has two divisions: Southern Division

Q69: Designing a new backpack at an outdoor

Q76: McGraw Company uses 5,000 units of

Q96: Younan Corporation manufactures two products: Product E47F

Q202: A manufacturing company that produces a single