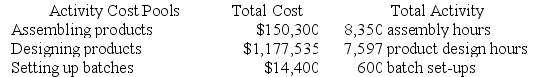

Data concerning three of Kilmon Corporation's activity cost pools appear below:

Required:

Required:

Compute the activity rates for each of the three cost pools. Show your work!

Definitions:

Exemptions

Specific allowances that relieve individuals, organizations, or products from fulfilling certain conditions or requirements, often for taxes or regulations.

Personal Income Tax

A tax levied on individuals or households based on their total income from various sources, including wages, salaries, and investments.

Taxable Income

The portion of an individual's or corporation’s income that is subject to taxes according to the laws and regulations of a particular jurisdiction.

Total Tax

The complete amount of tax owed by an individual or entity to the government within a specified period.

Q30: (Ignore income taxes in this problem.) Maxcy

Q35: Daston Company manufactures two products, Product F

Q51: Common fixed expenses should not be allocated

Q108: Tustin Corporation has provided the following data

Q123: Leaper Corporation uses an activity-based costing system

Q128: Hickingbottom Corporation has two production departments, Forming

Q134: The management of Leitheiser Corporation is considering

Q156: In activity-based costing, the activity rate for

Q234: A company has two divisions, each selling

Q281: J Corporation has two divisions. Division A