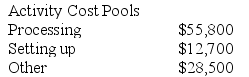

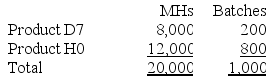

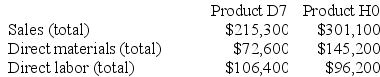

Zwahlen Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. Costs in the Processing cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs and activity-based costing system appear below:

Required:

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c. Determine the product margins for each product using activity-based costing.

Definitions:

Special Molds

Custom-designed molds used in manufacturing processes to produce unique product shapes or designs.

Variable Costs

Expenses that change in proportion to the activity of a business, such as the cost of raw materials used in production.

Unit Product Cost

The cost associated with producing a single unit of a product, including all direct and indirect costs.

Contribution Margin

Contribution Margin represents the portion of sales revenue that is not consumed by variable costs and contributes to covering fixed costs.

Q50: The management of Woznick Corporation has been

Q66: Howell Corporation's activity-based costing system has three

Q89: Data for January for Bondi Corporation and

Q129: Lotz Corporation has two manufacturing departments--Casting and

Q140: Moskowitz Corporation has provided the following data

Q142: Gerstein Corporation uses a job-order costing system

Q174: Wolanski Corporation has provided the following data

Q195: The Carter Corporation makes products A and

Q239: Job-order costing systems often use allocation bases

Q254: Elison Corporation, which has only one product,