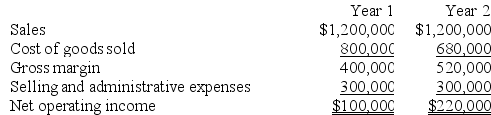

Miller Corporation produces a single product. The company had the following results for its first two years of operation:

In Year 1, the company produced and sold 40,000 units of its only product; in Year 2, the company again sold 40,000 units, but increased production to 50,000 units. The company's variable production cost is $5 per unit and its fixed manufacturing overhead cost is $600,000 a year. Fixed manufacturing overhead costs are applied to the product on the basis of each year's unit production (i.e., a new fixed manufacturing overhead rate is computed each year). Variable selling and administrative expenses are $2 per unit sold.

In Year 1, the company produced and sold 40,000 units of its only product; in Year 2, the company again sold 40,000 units, but increased production to 50,000 units. The company's variable production cost is $5 per unit and its fixed manufacturing overhead cost is $600,000 a year. Fixed manufacturing overhead costs are applied to the product on the basis of each year's unit production (i.e., a new fixed manufacturing overhead rate is computed each year). Variable selling and administrative expenses are $2 per unit sold.

Required:

a. Compute the unit product cost for each year under absorption costing and under variable costing.

b. Prepare a contribution format income statement for each year using variable costing.

c. Reconcile the variable costing and absorption costing income figures for each year.

d. Explain why the net operating income for Year 2 under absorption costing was higher than the net operating income for Year 1, although the same number of units were sold in each year.

Definitions:

Evolutionary Psychology

A theoretical approach in the social and natural sciences that examines psychological structure from a modern evolutionary perspective.

Functionalism

A theory in psychology that considers mental life and behavior in terms of active adaptation to the person's environment.

Venting Anger

The act of expressing or releasing feelings of anger in various ways, which can be constructive or destructive.

Research Study

An organized investigation conducted to answer specific questions or test hypotheses using scientific methods.

Q26: Gilchrist Corporation bases its predetermined overhead rate

Q61: Majid Corporation sells a product for $240

Q76: Tubaugh Corporation has two major business segments--East

Q88: Last year Easton Corporation reported sales of

Q98: Bryans Corporation has provided the following data

Q109: Housholder Corporation uses a predetermined overhead rate

Q162: Longobardi Corporation bases its predetermined overhead rate

Q180: Aaron Corporation, which has only one product,

Q202: A manufacturing company that produces a single

Q262: Beans Corporation uses a job-order costing system