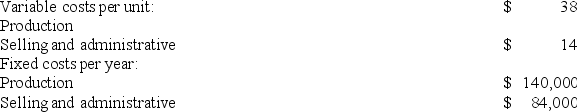

The Southern Corporation manufactures a single product and has the following cost structure:  Last year, 7,000 units were produced and 6,800 units were sold. There was no beginning inventory.

Last year, 7,000 units were produced and 6,800 units were sold. There was no beginning inventory.

Under absorption costing, the cost of goods sold for the year would be:

Definitions:

Direct Labor Variances

The difference between the actual costs of direct labor and the standard or expected costs, used for budgeting and financial analysis.

Direct Labor Costs

The expenses related to the wages of employees who are directly involved in the production or manufacturing of goods. This is a specific type of direct cost.

Property, Plant, and Equipment

Long-term tangible assets used in a company's operations and not expected to be converted to cash in the short term.

Standard Cost

A preset cost for delivering a product or service under normal conditions, used as a benchmark for measuring performance.

Q3: When unit sales are constant, but the

Q33: Sutter Corporation uses a job-order costing system

Q38: The management of Schmader Corporation is considering

Q50: Variable manufacturing overhead costs are treated as

Q56: Key Corporation is considering the addition of

Q114: Masley Corporation has provided the following data

Q133: Scheuer Corporation uses activity-based costing to compute

Q159: Ferrar Corporation has two major business segments:

Q288: The costs attached to products that have

Q292: Atteberry Corporation has two manufacturing departments--Machining and