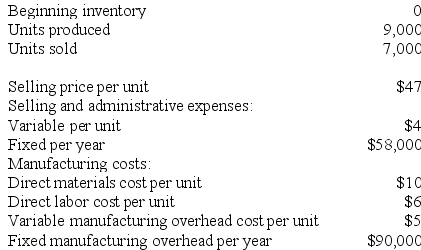

The Dorset Corporation produces and sells a single product. The following data refer to the year just completed:

Assume that direct labor is a variable cost.

Assume that direct labor is a variable cost.

Required:

a. Compute the unit product cost under both the absorption costing and variable costing approaches.

b. Prepare an income statement for the year using absorption costing.

c. Prepare an income statement for the year using variable costing.

d. Reconcile the absorption costing and variable costing net operating income figures in (b) and (c) above.

Definitions:

Units-Of-Output Depreciation

A depreciation method that allocates an asset's cost based on its usage or production levels, rather than simply the passage of time.

Depreciable Cost

The total cost of a tangible asset that is subject to depreciation, excluding salvage value, to allocate over the asset's useful life.

Depreciation Rate

The percentage rate at which an asset is depreciated across its useful life, affecting the value of the asset on the balance sheet over time.

Straight-Line Method

A method of calculating depreciation by dividing the cost of an asset, minus its salvage value, by its useful life.

Q14: Moyas Corporation sells a single product for

Q26: Tubaugh Corporation has two major business segments--East

Q29: Silver Corporation produces a single product. Last

Q88: Departmental overhead rates will correctly assign overhead

Q120: Variable expenses for Alpha Corporation are 40%

Q127: An increase in the number of units

Q141: Batch-level activities are performed each time a

Q175: Pavelko Corporation has provided the following data

Q225: Tubaugh Corporation has two major business segments--East

Q246: Obermeyer Corporation uses a job-order costing system