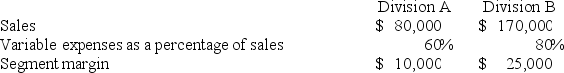

Eyestone Corporation has two divisions, A and B. The following data pertain to operations in October:  If common fixed expenses were $17,000, total fixed expenses were:

If common fixed expenses were $17,000, total fixed expenses were:

Definitions:

Manufacturing Equipment

The machinery and tools used in the manufacturing process to produce goods or products.

Conversion Cost

The combined costs of direct labor and manufacturing overhead involved in transforming materials into finished goods.

Prime Cost

The sum of direct materials and direct labor costs in the production of goods, excluding overhead expenses.

Inventoriable Cost

Direct costs associated with the production of goods, including materials and labor, that are capitalized as inventory on the balance sheet until sold.

Q1: Under variable costing, only variable production costs

Q4: Beamish Inc., which produces a single product,

Q59: Kostelnik Corporation uses a job-order costing system

Q160: Hails Corporation manufactures two products: Product Q21F

Q161: Lusk Corporation produces and sells 10,000 units

Q178: Merati Corporation has two manufacturing departments--Forming and

Q202: A manufacturing company that produces a single

Q202: Florek Corporation uses a job-order costing system

Q223: Most countries require some form of absorption

Q251: Bolander Corporation uses a job-order costing system