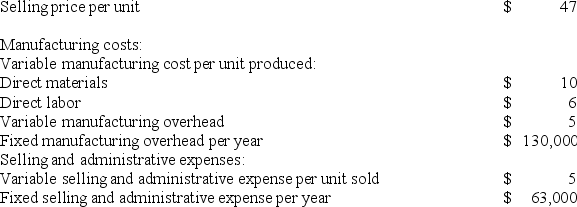

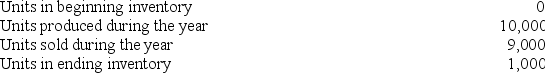

Baraban Corporation has provided the following data for its most recent year of operation:

The unit product cost under absorption costing is closest to:

The unit product cost under absorption costing is closest to:

Definitions:

Machine Hours

Machine hours refer to the total operating time of a machine or group of machines during a specific period, used as a basis for allocating costs in manufacturing.

Departmental Overhead Rates

Costs associated with a department's operations that are distributed across products or services, often based on a predetermined rate.

Machine Hours

A measure used in costing to allocate costs based on the number of hours a machine is operated.

Direct Labor Hours

A measure of the total hours worked directly on producing goods, typically used in manufacturing and cost accounting.

Q13: Wyrich Corporation has two divisions: Blue Division

Q44: Melbourne Corporation has traditionally made a subcomponent

Q69: When using data from a segmented income

Q92: The fact that one department may be

Q100: Collini Corporation has two production departments, Machining

Q152: The most recent monthly income statement for

Q163: Warrix Corporation has provided the following contribution

Q167: Baj Corporation uses a predetermined overhead rate

Q191: Activity rates from Lippard Corporation's activity-based costing

Q211: Immen Corporation manufactures two products: Product B82O