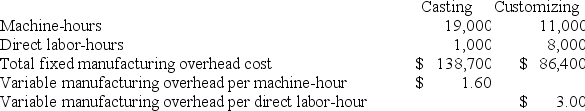

Swango Corporation has two production departments, Casting and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  The estimated total manufacturing overhead for the Customizing Department is closest to:

The estimated total manufacturing overhead for the Customizing Department is closest to:

Definitions:

Employee Engagement

The level of an employee's emotional investment, commitment, and enthusiasm towards their work and organization.

Quarterly Bonus

Additional compensation given to employees on a quarterly basis, often linked to performance or organizational profitability.

Sales Targets

Specific, quantifiable objectives set for a sales team or individual sales representatives to achieve within a specific time frame.

Training

An organization's planned efforts to help employees acquire job-related knowledge, skills, abilities, and behaviors, with the goal of applying these on the job.

Q3: The contribution margin ratio of Kuck Corporation's

Q17: Addleman Corporation has an activity-based costing system

Q19: Vanliere Corporation has two production departments, Machining

Q114: Product costs are also known as inventoriable

Q146: Morataya Corporation has two manufacturing departments--Machining and

Q171: McCoy Corporation manufactures a computer monitor. Shown

Q193: Assuming the LIFO inventory flow assumption, when

Q204: Neef Corporation has provided the following data

Q221: Kubes Corporation uses a job-order costing system

Q256: Data for January for Bondi Corporation and