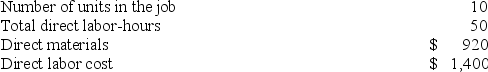

Beans Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $162,000, variable manufacturing overhead of $2.80 per direct labor-hour, and 60,000 direct labor-hours. Recently, Job K818 was completed with the following characteristics:  The amount of overhead applied to Job K818 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied to Job K818 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Bailments

The temporary handover of control or possession of personal property by one party, the bailor, to another, the bailee, for a specific purpose.

Bailee's Sole Benefit

Bailee's sole benefit occurs when a bailment is made for the advantage of the bailee only, with no benefit accruing to the bailor.

Gratuitous Loan

A loan where the lender does not charge interest or fees, often made among family or friends or for charitable reasons.

Bailor's Sole Benefit

Refers to a situation in a bailment where the benefit of the arrangement is exclusively for the bailor, with the bailee undertaking the responsibility without receiving any benefit.

Q35: Spiess Corporation has two major business segments--Apparel

Q91: In a traditional format income statement, the

Q111: Flemming Corporation uses activity-based costing to compute

Q131: Variable costing net operating income is usually

Q131: Koelsch Corporation has two manufacturing departments--Molding and

Q183: Bassett Corporation has two production departments, Milling

Q184: Mandato Corporation has provided the following data

Q197: Data concerning three of Kilmon Corporation's activity

Q223: Product Y sells for $15 per unit,

Q249: Session Corporation uses a job-order costing system