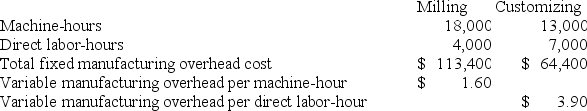

Comans Corporation has two production departments, Milling and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job A319. The following data were recorded for this job:

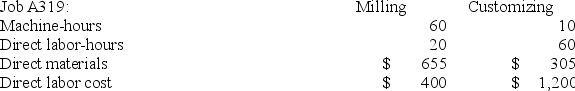

During the current month the company started and finished Job A319. The following data were recorded for this job: The amount of overhead applied in the Customizing Department to Job A319 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Customizing Department to Job A319 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Revenue Management

The use of analytics and data to predict consumer behavior, optimize product availability and pricing, and maximize revenue growth.

Differential Pricing

Differential pricing is a strategy where a company charges different prices for the same product or service in different markets or segments, based on factors like customer willingness to pay, market demand, or competition.

Supply Chain Surplus

The difference between the value generated by the final product to the end consumer and the costs involved in the supply chain.

Fashion Apparel

Clothing and accessories designed and manufactured according to current trends and styles.

Q17: Job 652 was recently completed. The following

Q156: Fernstrom Corporation has two divisions: East and

Q163: Doles Corporation uses the following activity rates

Q168: Morataya Corporation has two manufacturing departments--Machining and

Q173: If the allocation base in the predetermined

Q218: Davitt Corporation produces a single product and

Q251: Azuki Corporation operates in two sales territories,

Q252: Garza Corporation has two production departments, Casting

Q255: Prather Corporation uses a job-order costing system

Q286: Jurica Corporation has two production departments, Forming