Doles Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products.

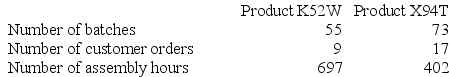

Data concerning two products appear below:

Data concerning two products appear below:

Required:

Required:

How much overhead cost would be assigned to each of the two products using the company's activity-based costing system?

Definitions:

Retail Outlets

Physical stores where products are sold directly to consumers.

Retailing Mix

The combination of factors used by retailers to attract customers and sell goods, including product assortment, pricing strategies, promotional activities, and locations.

Diverse Portfolio

An investment strategy that spreads assets among various types of investments, industries, and geographic locations to manage risk.

Retail Mix

The combination of factors within a retail strategy, including product assortment, pricing, store layout, and promotional tactics aimed at influencing consumer behavior.

Q74: Which of the following is true of

Q86: Levron Corporation uses a job-order costing system

Q94: A duration driver provides a simple count

Q101: Boney Corporation processes sugar beets that it

Q118: Companies often allocate common fixed costs among

Q147: Flemming Corporation uses activity-based costing to compute

Q156: Janicki Corporation has two manufacturing departments--Machining and

Q159: Torello Corporation manufactures two products: Product H95V

Q196: The appeal of using multiple departmental overhead

Q200: A manufacturing company that produces a single