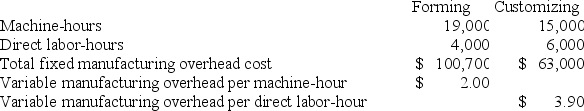

Jurica Corporation has two production departments, Forming and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  The predetermined overhead rate for the Forming Department is closest to:

The predetermined overhead rate for the Forming Department is closest to:

Definitions:

Stockholders' Equity

The portion of a company's assets that belongs to the shareholders after debts and liabilities have been settled.

Common Stock

Shares representing ownership in a company, entitling holders to vote at shareholder meetings and receive dividends.

Net Income

The conclusive earnings a company retains after all operational costs and taxes are taken away from the revenues.

Statement of Cash Flows

A financial document that provides a summary of the cash inflows and outflows for a company over a specific period of time, showing how it raises and spends money.

Q10: Comparative income statements for Boggs Sports Equipment

Q18: Data concerning Lemelin Corporation's single product appear

Q39: Brault Corporation has provided the following information:

Q54: Swango Corporation has two production departments, Casting

Q115: Which of the following costs at a

Q185: Which of the following is an example

Q200: Committed fixed costs represent organizational investments with

Q230: Delisa Corporation has two divisions: Division L

Q238: Conversion cost is the sum of direct

Q255: Carriveau Corporation has two divisions: Consumer Division