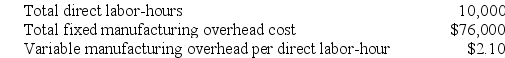

Leadley Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:

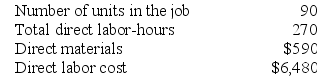

Recently Job X701 was completed with the following characteristics:

Recently Job X701 was completed with the following characteristics:

Required:

Required:

a. Calculate the estimated total manufacturing overhead for the year.

b. Calculate the predetermined overhead rate for the year.

c. Calculate the amount of overhead applied to Job X701.

d. Calculate the total job cost for Job X701.

Definitions:

Partial Equity Method

An accounting method used for investments where the investor has significant influence, recording income based on the proportion of earnings rather than dividends received.

Investment Account

An account held at a financial institution and managed by an investment dealer that contains securities for investment purposes.

Goodwill

Goodwill represents the excess of the purchase price over the fair market value of the net identifiable assets acquired in a business combination. It is an intangible asset associated with the purchase of one company by another.

Partial Equity Method

An accounting method used by companies to record their investments in other companies when they can exert significant influence but do not have full control.

Q34: A manufacturer of cedar shingles has supplied

Q103: Rhome Corporation's relevant range of activity is

Q112: Zanetti Corporation produces and sells a single

Q120: Aaron Corporation, which has only one product,

Q129: Meginnis Corporation's relevant range of activity is

Q137: Janicki Corporation has two manufacturing departments--Machining and

Q197: Juanita Corporation uses a job-order costing system

Q249: Fowler Corporation manufactures a single product. Operating

Q255: Haslem Inc. has provided the following data

Q283: Kneeland Corporation has provided the following information: