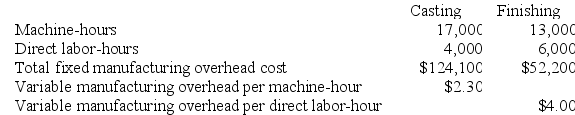

Rocher Corporation has two production departments, Casting and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

During the current month the company started and finished Job A394. The following data were recorded for this job:

During the current month the company started and finished Job A394. The following data were recorded for this job:

Required:

Required:

a. Calculate the estimated total manufacturing overhead for the Casting Department.

b. Calculate the predetermined overhead rate for the Casting Department.

c. Calculate the amount of overhead applied in the Casting Department to Job A394.

Definitions:

Long-Term Contracts

Agreements that establish the terms for ongoing services or project work that lasts over an extended period, often involving incremental delivery and payment schedules.

Contract Loss

A financial loss encountered in a contract when the total costs exceed the revenue earned from the contract, typically recognized in construction or long-term projects.

Percentage-of-Completion Method

An accounting method used to recognize revenue and expenses of long-term contracts in proportion to the work completed.

Estimated Revenues

Projections of the amount of money a business expects to receive from its activities or sales within a specific period.

Q34: A manufacturer of cedar shingles has supplied

Q58: Ashe Corporation has two manufacturing departments--Machining and

Q113: Variable costs per unit are not affected

Q148: Jerrel Corporation sells a product for $230

Q154: Within the relevant range, variable costs can

Q159: Remmel Corporation has provided the following contribution

Q163: Odonnel Corporation uses a job-order costing system

Q224: Ahlheim Corporation has two production departments, Forming

Q249: Data concerning Lemelin Corporation's single product appear

Q274: Ronson Corporation has two manufacturing departments--Casting and