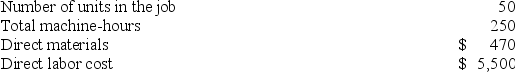

Coates Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $249,000, variable manufacturing overhead of $3.80 per machine-hour, and 30,000 machine-hours. The company has provided the following data concerning Job X784 which was recently completed:  If the company marks up its unit product costs by 30% then the selling price for a unit in Job X784 is closest to: (Round your intermediate calculations to 2 decimal places.)

If the company marks up its unit product costs by 30% then the selling price for a unit in Job X784 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Operating Expenses

Expenses incurred from a company's primary business activities, excluding cost of goods sold, such as rent, salaries, and utility bills.

Gross Profit

The difference between revenue and the cost of goods sold, before deducting overhead, payroll, taxation, and interest.

Cost of Goods Sold

Cost of goods sold is the direct costs attributable to the production of the goods sold by a company, including material and labor expenses.

Gross Profit Rate

The ratio of gross profit to net sales, expressed as a percentage, indicating the efficiency of a company in managing its direct costs.

Q27: Hadley Corporation, which has only one product,

Q31: The July contribution format income statement of

Q44: Madole Corporation has two production departments, Forming

Q46: Addleman Corporation has an activity-based costing system

Q62: Mckissic Corporation has two divisions: Domestic and

Q71: Verry Corporation uses a job-order costing system

Q99: Ieso Corporation has two stores: J and

Q123: Sarratt Corporation's contribution margin ratio is 62%

Q173: Segment margin is sales less variable expenses

Q266: Prayer Corporation has two production departments, Machining