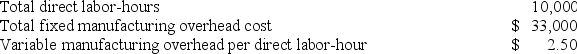

Decorte Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job K332 was completed with the following characteristics:

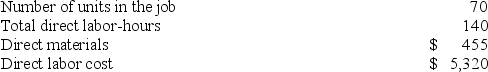

Recently, Job K332 was completed with the following characteristics: The amount of overhead applied to Job K332 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied to Job K332 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Wage Rate

The amount of money paid to an employee for a unit of time worked, typically expressed per hour or year.

Leisure

Represents time that an individual spends away from work and other compulsory activities, often used for relaxation, recreation, or personal interests.

Nonlabor Income

Earnings received from sources other than employment, such as investments, pensions, or inheritances.

Wage Rate

The amount of compensation an employee receives per unit of time or output, typically expressed per hour or piece.

Q1: Under variable costing, only variable production costs

Q9: Lupo Corporation uses a job-order costing system

Q39: Comans Corporation has two production departments, Milling

Q58: Ashe Corporation has two manufacturing departments--Machining and

Q64: Harootunian Corporation uses a job-order costing system

Q67: A tile manufacturer has supplied the following

Q73: Janos Corporation, which has only one product,

Q148: Weakley Corporation uses a predetermined overhead rate

Q241: The relevant range is the range of

Q247: Janos Corporation, which has only one product,